Arbol: The Future is Insured

Designing a comprehensive parametric insurance platform that has transferred $2+ billion in climate risk coverage across 15+ countries, revolutionizing how the world manages climate-related financial risks.

The Challenge

In 2023, the world faced 398 natural disasters causing $380 billion in losses with a 69% global protection gap. Traditional insurance struggles to scale coverage for climate risks, leaving businesses vulnerable to weather-related disruptions.

The Solution

Created a comprehensive parametric insurance platform that offers swift, objective, and scalable coverage through AI-powered risk assessment and blockchain-based smart contracts, eliminating disputes and delays.

The Impact

Positioned Arbol as the #1 writer of global non-CAT parametric climate risk, transferring over $2 billion in notional risk across 15+ countries, with 50% of clients gaining access to climate risk products for the first time.

Platform Success Metrics

Understanding the Climate Risk Problem

The global protection gap in climate risk coverage represents one of the most pressing challenges facing businesses today. Traditional insurance models are failing to scale effectively.

Traditional Insurance Limitations

- Lengthy claims processes taking months to resolve

- Subjective damage assessments leading to disputes

- Limited coverage for emerging climate risks

- High barriers to entry for smaller businesses

Parametric Insurance Advantages

- Payments issued in as little as 2 weeks

- Objective, third-party data verification

- Transparent, automated payouts

- Scalable coverage for diverse risk profiles

Design Process & Methodology

Research

Market analysis, user interviews, competitive research

Ideation

Concept development, user journey mapping

Design

Wireframing, prototyping, visual design

Validation

User testing, iteration, performance monitoring

Brand Identity & Visual System

Trust-Driven Visual Language

Developed a sophisticated brand identity that balances cutting-edge technology with the reliability required in financial services. The visual system emphasizes transparency, data accuracy, and global accessibility.

Global Accessibility

Design system that works across diverse markets and regulatory environments, supporting 15+ countries.

Data Transparency

Visual elements that emphasize data integrity and objective risk assessment methodologies.

Financial Credibility

Professional aesthetics that instill confidence in high-value financial transactions and risk transfer.

Platform User Experience Design

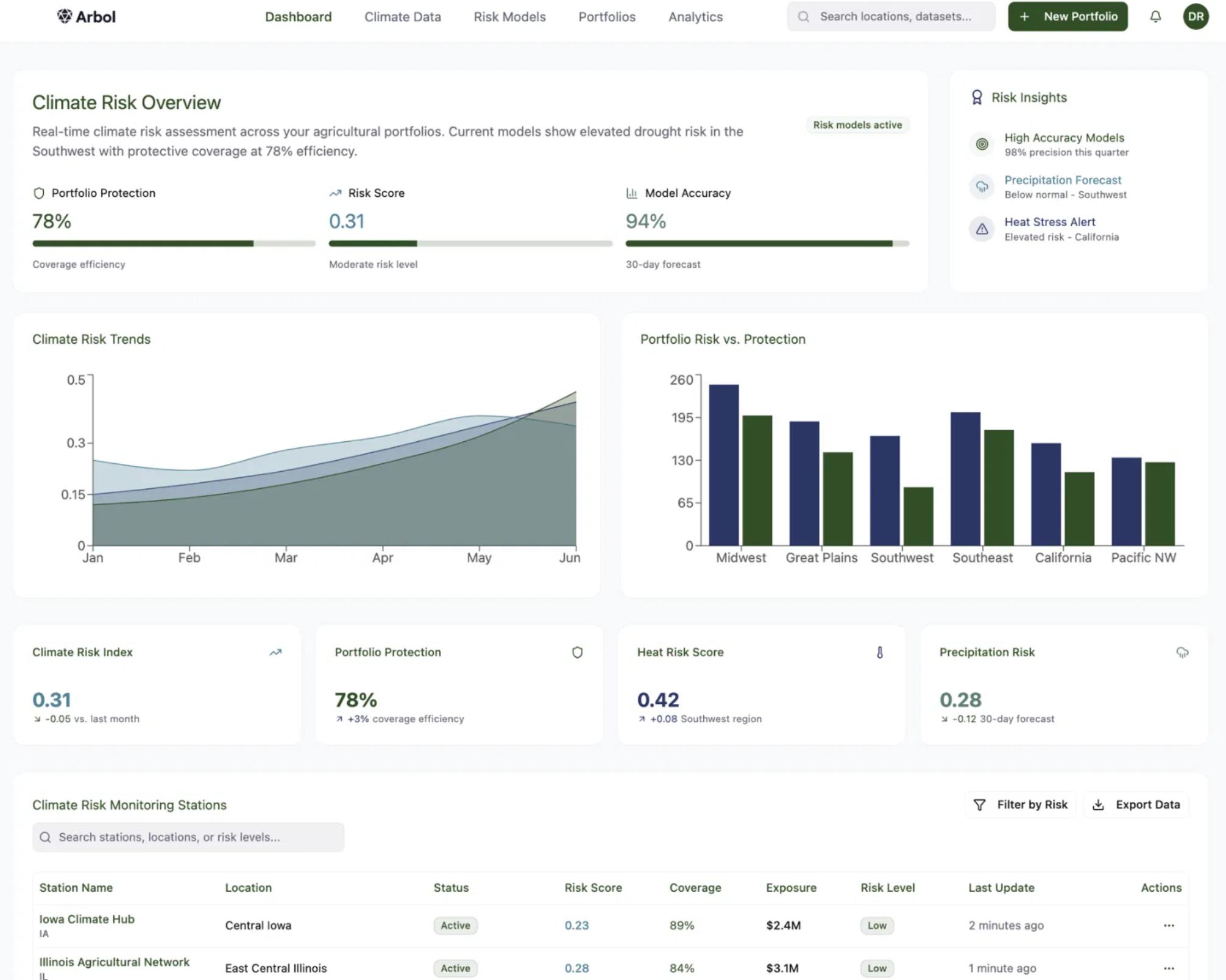

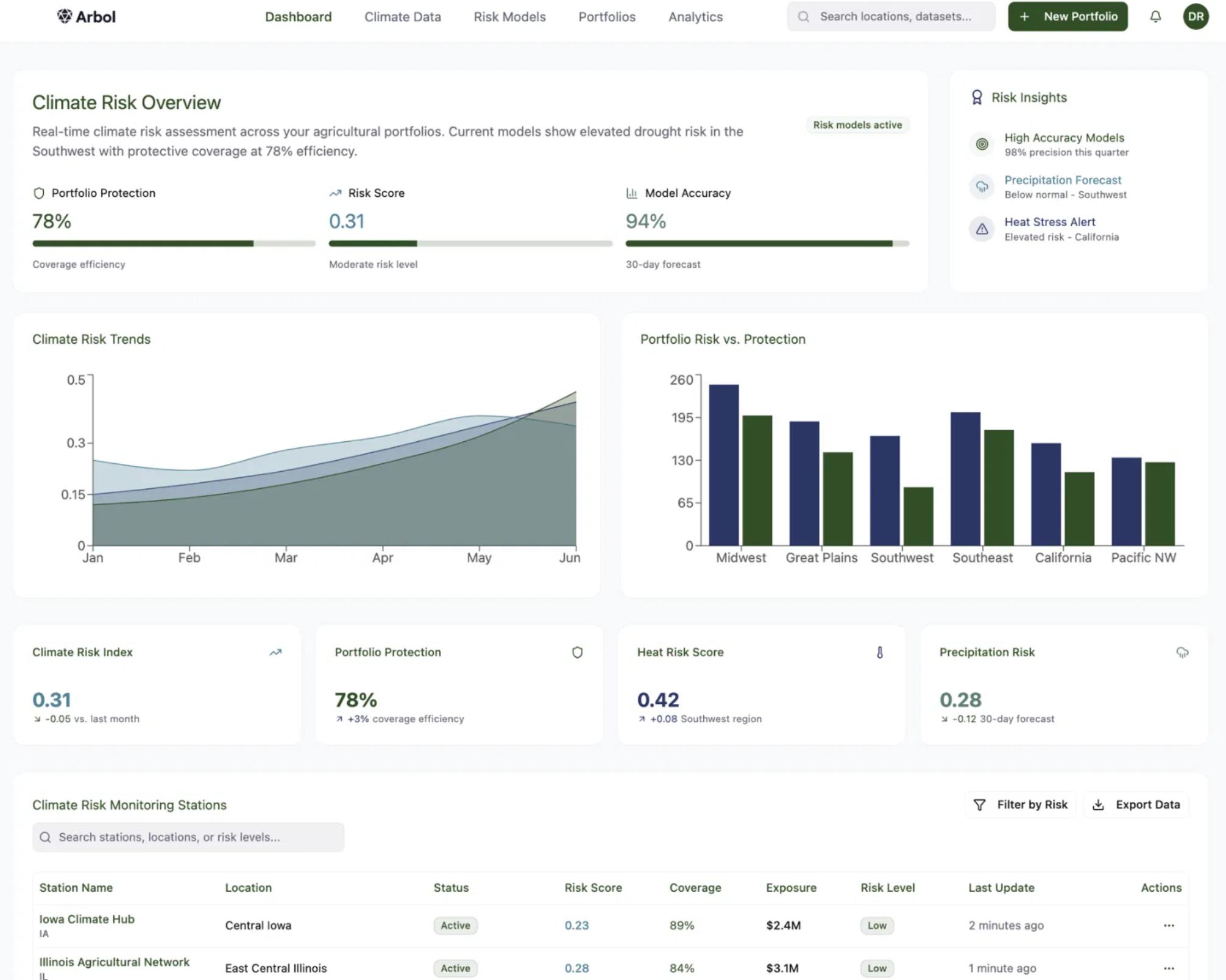

Risk Assessment Dashboard

Designed intuitive dashboards that transform complex climate data, weather patterns, and risk metrics into actionable insights for underwriters and clients.

- Real-time weather data integration

- AI-powered risk modeling visualization

- Multi-source data validation indicators

- Geographic risk mapping tools

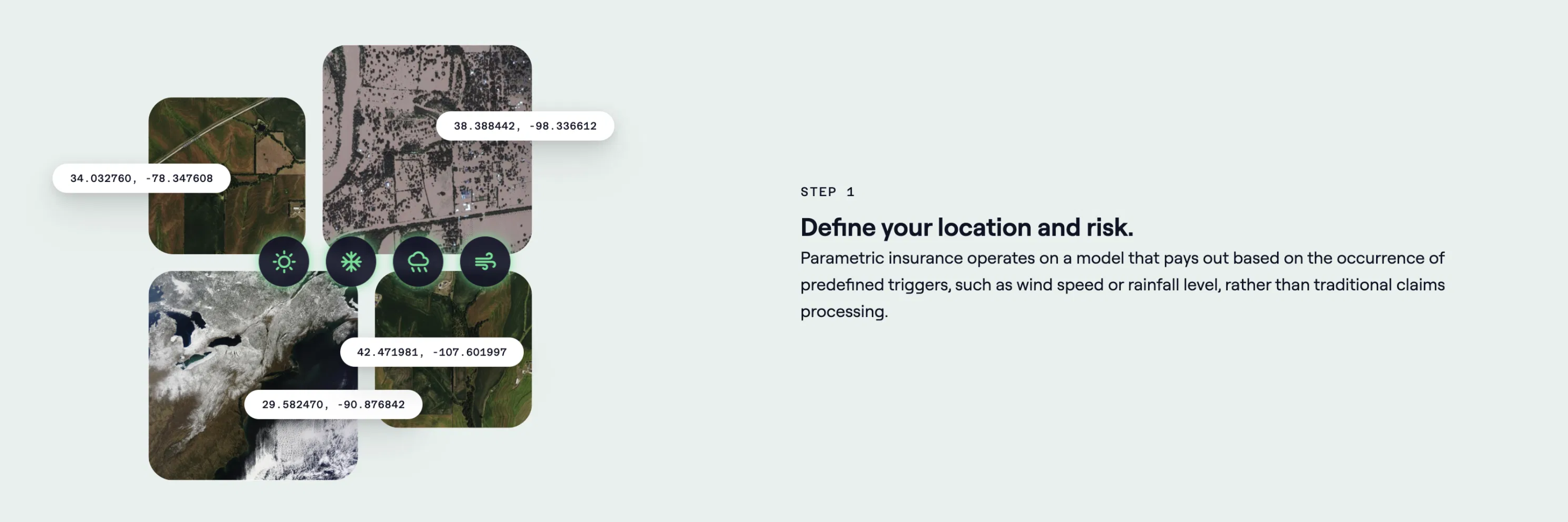

Parametric Contract Builder

Streamlined the complex process of creating parametric insurance contracts through guided workflows, intelligent parameter suggestions, and real-time pricing calculations.

- Step-by-step contract configuration

- Dynamic pricing optimization

- Risk parameter validation

- Regulatory compliance checks

Client Portal & Mobile Access

Created responsive client-facing interfaces that provide real-time coverage status, claim tracking, and payout notifications accessible from anywhere in the world.

- Real-time coverage monitoring

- Automated payout notifications

- Multi-language support

- Cross-platform compatibility

Arbol Technology Ecosystem

Expansive Data Infrastructure

Integration with NOAA, NASA, ESA, and commercial data sources for institutional-grade climate intelligence and risk assessment.

AI/ML Underwriter

Machine learning algorithms that enhance underwriting precision and optimize risk assessment accuracy across diverse market conditions.

Arbol Platform

Integrated platform with advanced analytics to streamline client enrollment and coverage management for agents and brokers.

Flexible Risk Capital

Dedicated risk capacity enabling bespoke and tailored solutions for diverse client needs across multiple industries and regions.

Blockchain Integration

Smart contracts ensuring transparent, automated, and tamper-proof insurance execution with objective payout triggers.

Diverse Client Base

Serving everyone from small farmers to large corporations with tailored insurance solutions for unique climate challenges.

Project Impact & Results

"The 6,600 bales we ginned was just about enough to pay the light bill… with very little cotton there was no income, so this [payment from Arbol] is going to be a large chunk of the income that comes in for my bank this year."— Al Crisp, Owner, Punkin Center Gin, Lamesa, TX

The comprehensive platform design has positioned Arbol as a global leader in parametric insurance, closing critical protection gaps and enabling unprecedented access to climate risk coverage across diverse markets and industries.

Key Design Insights

Simplifying Complexity

The biggest challenge was making sophisticated financial and meteorological concepts accessible to diverse user groups, from small farmers to enterprise risk managers.

Solution: Progressive disclosure, contextual help, and visual data representation that guides users through complex processes step-by-step.

Building Trust Through Transparency

Insurance inherently involves trust, but parametric insurance required explaining entirely new concepts to build confidence in automated payouts.

Solution: Real-time data source visualization, clear payout trigger explanations, and comprehensive audit trails for all transactions.

Global Scalability

Designing for 15+ countries meant accommodating different regulatory environments, currencies, languages, and risk profiles.

Solution: Modular design system with configurable components, multi-currency support, and adaptable risk modeling frameworks.

Real-Time Decision Making

Users needed immediate access to critical information during weather events and risk scenarios to make informed decisions.

Solution: Mobile-first design with push notifications, offline capabilities, and streamlined interfaces for emergency situations.